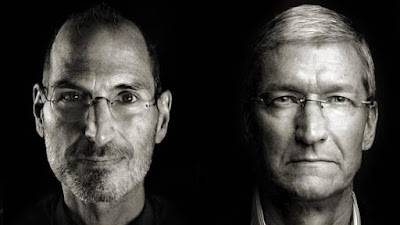

Cook's first decade of leading the world's most valuable company was successful, but the next decade will be difficult.

Monday 30 August 2021

Cook's ten years: perhaps a more successful Apple CEO than Jobs

Tuesday 17 August 2021

The dismissed tech giant is still so profitable

Regulators put the technology giants in hot water, but their stocks will not continue to be sluggish.

In the three days at the end of July, American technology giants performed brilliantly. Apple, Microsoft, Alphabet (the parent company of Google), Amazon and Facebook thrive in the epidemic, and their latest earnings reports confirm this. In the latest quarter from April to June this year, these five companies achieved total revenues of US$332 billion, an increase of 36% year-on-year, and their earnings were better than expected. Unexpectedly, in addition to Alphabet, the stocks of several companies triggered a wave of selling after their earnings were announced.

This negative reaction embodies the paradox surrounding the major American technology companies. While products are being used more, big technology companies themselves are increasingly disgusted. Encouraged by voters from both parties, regulators and legislators are reviewing every business of big technology companies and threatening to take strong measures to curb their power. Mark Mhaney, an analyst at Evercore ISI, predicts that the drag on the stocks of major technology companies from the regulatory review has reached 10% of the stock prices.

Virtual Meeting Rescues Workplaces

How to make employees, customers and investors live together harmoniously in the meeting. The lobby can shape people's first impression...

-

How to make employees, customers and investors live together harmoniously in the meeting. The lobby can shape people's first impression...

-

Cook's first decade of leading the world's most valuable company was successful, but the next decade will be difficult. However slow...

-

Have you been cut off the electricity? In the past few days, power-limiting has been a very popular term. "Dual-control" and &quo...